Have crypto, will invest: The race to manage other people’s crypto assets

The advent of token crowdsales or ‘initial coin offerings’ (ICOs) has spurred blockchain startups around the world to launch their own cryptocurrencies to raise money. At present, at least 1,500 tokens have been created.

For inexperienced or first-time investors, setting up a wallet to hold cryptocurrency, knowing what to invest in, and navigating the dizzying number of tokens – while keeping track of price fluctuations – can be challenging.

Mohit Mamoria, CEO of Authorito Capital, says he sees this struggle among users of his cryptocurrency hedge fund. “They want to invest in crypto but they do not know how to get started.”

He continues, “That’s where we come into the picture and say, we [will] help you buy bitcoin. Then you send us those bitcoins and we will manage those crypto investments for the next five years.”

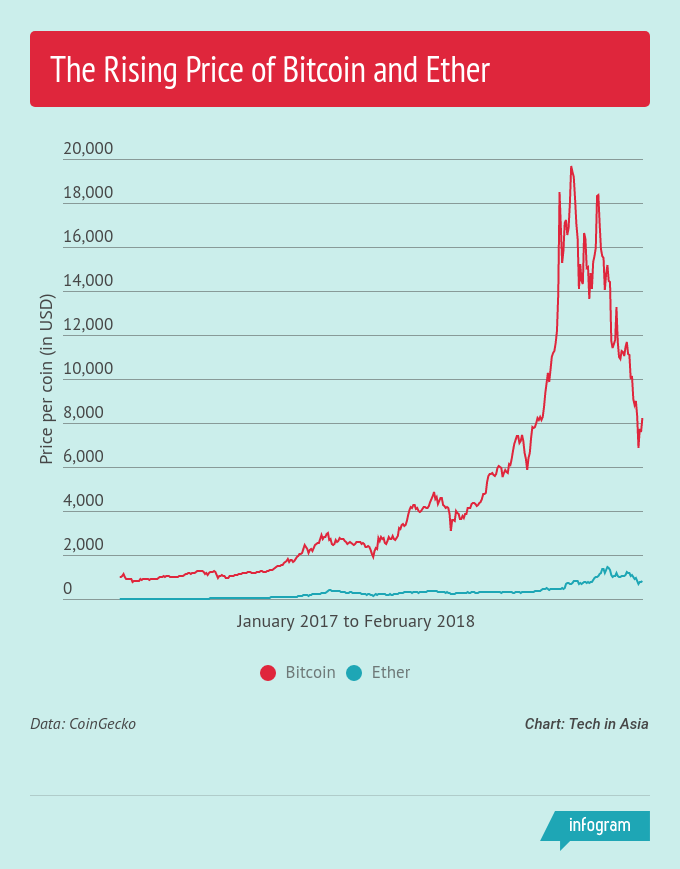

In 2017, the price of bitcoin jumped from around US$1,000 to US$19,000 at its peak. The price of ether also grew from less than US$100 to almost US$1,500 at its highest.

Over the past year, the rising price of bitcoin has drawn investors from all backgrounds, both retail and institutional. Despite the price drop this month, appetite for trading and investment remains high, with top exchanges turning over more than US$1 billion in trade volume daily, according to CoinMarketCap.

In addition to more established coins like bitcoin, investors are also turning to more volatile tokens – conceived from ICOs – for a faster return.

However, many investors lack the know-how and resources to successfully manage their own portfolio. This gap has created a small, but growing industry of cryptocurrency funds and middlemen. Some blockchain startups are even building marketplaces for asset managers and aspiring crypto investors, such as Slovenia-based ICONOMI, which has dubbed itself the ‘Uber of fund management.’

“Retail investors are interested in buying into crypto index funds as an easy way to gain passive exposure to the cryptocurrency market,” says T.M Lee, co-founder of CoinGecko, a cryptocurrency ranking and analysis site.

For investors, it’s advantageous to “spread the risk across different cryptocurrencies […] and to not have manage multiple different wallets,” he adds.

Tokenized funds

As a young industry, cryptocurrency asset management is still very much in the experimentation phase. Some manage less than US$25 million of capital, while others have around US$150 million.

Many are quasi hedge or mutual funds, where investment strategies are a mix of day trading, ICO investments, and long-term bets on blockchain startups. Others are more similar to venture capital funds, except they’re open to retail investors.

They want to invest in crypto but they do not know how to get started.

In some cases, the funds themselves are tokenized. In exchange for tokens issued by the fund – sometimes through an ICO – investors pay up with bitcoin, ether, or fiat currency.

For instance, Blockchain Capital, a venture capital firm founded in 2013, raised US$10 million in its own ICO last April. The fund’s token, BCAP, is supposed to represent a share of the fund. In theory, as Blockchain Capital reaps returns on ICO investments, the value of the fund’s assets should increase – and thus the value of BCAP itself.

These tokens are “designed to be backed by a portfolio of investments in cryptocurrencies,” explains Lee. Instead of having to track a multitude of coins, investors hold onto just one.

Tokens are also a way for investors to make money without having to cash out, since they can trade them on secondary markets – assuming the coin is listed on an exchange. The fund itself typically takes a 1 to 3 percent management fee, while raking in 20 percent of profits – similar to traditional hedge funds.

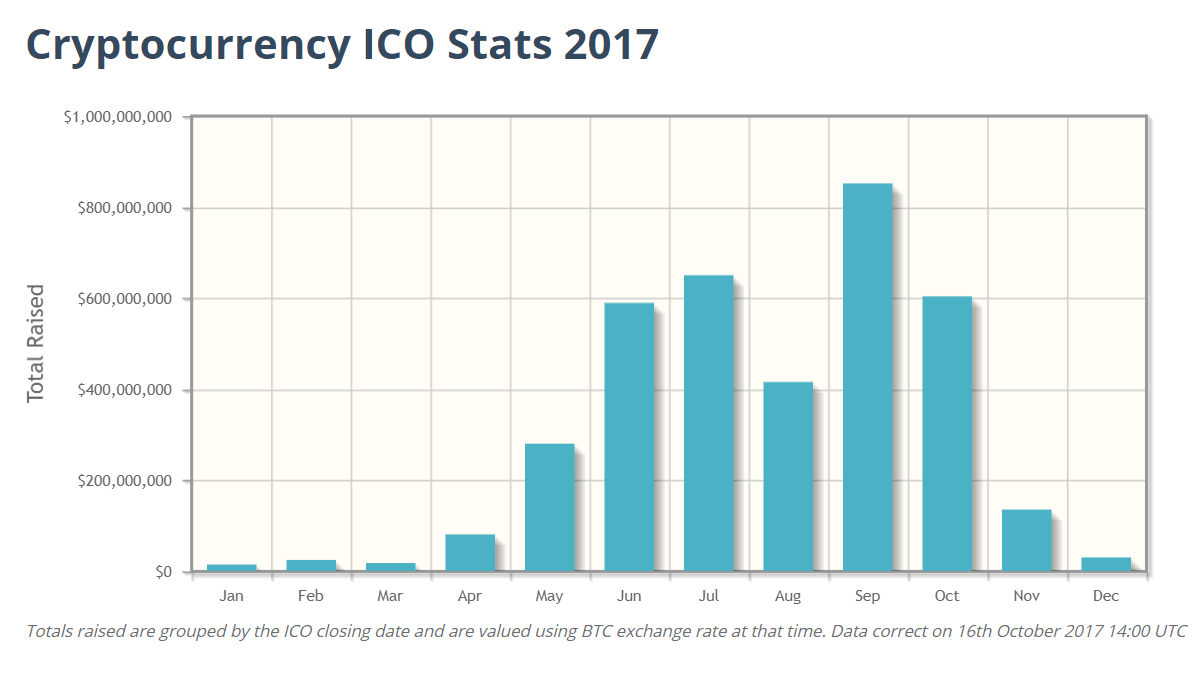

Data from Coinschedule shows that companies raised US$3.7 billion in cryptocurrency from ICOs in 2017.

Even though the blockchain industry is largely unregulated, some funds are taking extra precautions, especially since their tokens usually count as securities.

“If we take money from Singapore, it becomes our responsibility to make sure that the person who has primary residence in Singapore is an accredited investor,” says Mamoria, explaining the identity vetting and anti-money-laundering checks that Authorito Capital has to do on its investors.

The New Delhi-headquartered fund also doesn’t accept anyone from the US, “because of the SEC’s regulations around security tokens,” he adds.

Other companies are staying close to government bodies as regulations are hashed out. “We are in constant talks with different regulators where we try to present our views on the crypto ecosystem,” says Matej Tomazin, COO of crypto-asset management platform ICONOMI. If the company isn’t proactive, they “will definitely be surprised” by the regulations that come out, he adds.

Pain points

To be sure, investing in cryptocurrency funds may be even riskier than taking the leap on your own. Some funds require lengthy lock-in periods – such as five years – that can be nerve-wracking, given that many of these cryptocurrency funds have little to no track record to speak of. Being able to trade the fund’s tokens in the short term also isn’t guaranteed, as it depends on whether or not the fund can get its coin listed on an exchange.

To make matters worse, some organizations offer little transparency on their operations and investment returns. In short, it’s very possible for fund managers to perform poorly or run away with investor money without any serious consequences.

In most cases, these funds “do not fulfill the requirements of prospectus laws, which means that fund managers have carte blanche with the funds at hand,” says Andreas Slabber, who oversees all crypto-related businesses for SGG Group, an investment services company headquartered in Luxembourg. If they decide to take off with said funds, investors are left “with no legal recourse.”

Two of the largest hacks in blockchain history involve Tokyo-based exchanges: Coincheck and Mt. Gox. Photo credit: Redd Angelo / Unsplash

Security is another concern. Trading cryptocurrency is one thing, but securely holding it is another. Large-scale exchange heists, such as the recent US$400 million hack of Coincheck, highlight the risks of managing millions of dollars’-worth in cryptocurrency.

“That whole process of holding assets yourself makes it prohibitively difficult for traditional institutional investors to gain [cryptocurrency] assets,” notes Kunyi Li, founder of Ariadne Advisory, a consultancy for cryptocurrency hedge funds.

In the traditional finance world, there are custodians who act like “a safety lockbox,” he shares. “What it essentially means is that when you do a trade, you’re operating on accounts that are held elsewhere, so you never have to worry about security.” But custodianship hasn’t matured yet in the cryptocurrency world, so hedge funds often have to provide that for clients as well.

Services for the elite

In the end, retail investors – the ones with the least capital and access to quality blockchain projects – may not be able to participate in the best funds. Some funds only work with institutional investors and high net worth individuals, or require a minimum investment of US$50,000 or more.

For instance, Hong Kong-based hedge fund Kenetic Capital mainly serves family offices and wealthy angel investors. BlockTower Capital, a US cryptocurrency hedge fund founded by an ex-Goldman Sachs executive, only serves institutional investors.

We just don’t have enough capital.

Still, the need for more education among smaller, retail investors has led some to take matters into their own hands. Rahwa Berhe, who bought her first bitcoin last September, has started a community-run cryptocurrency investment pool in Seattle. A lot of young, low-to-medium income professionals have joined the group, which holds board meetings every month to discuss investment strategy and the collective portfolio.

“The reason why I put it together was because so many friends called me, asking what coins to buy, tips and tricks, and such – I was really concerned,” says Berhe. “I felt like people saw an opportunity to make money, and they were just throwing their money in a direction, hoping that it bubbles.”

The most important feature of the group is how everyone is regarded as “an active agent,” according to Berhe, emphasizing that all decisions are consensus-based. And unlike a hedge or mutual fund, no fees are charged and it’s not “hands-off” investing.

Those traditional asset management services aren’t “open to people from my community” anyway, she adds. “We just don’t have enough capital.”

Tidak ada komentar: